CEO Connect #1, April 2023

April 5, 2023

Environmental, Social and Governance (ESG) Plan 2023–2025

May 2, 2023Understanding the current "hard" market

Key Takeaways

- Insurance pricing expected to continue rising through 2023.

- Uncertainty due to rising natural catastrophe losses, high inflation and lower investment returns have impacted market risk appetite.

- Mutual Members can influence pricing by:

- Risk improvement actions

- Data quality

- Unimutual is here to help.

What we are seeing

Following on from a challenging 2022, our experience at the 1 January 2023 reinsurance renewal season has led us to believe that we should expect increases in reinsurance costs to continue through 2023. As reinsurance costs are a significant component of insurance premium, this will be passed on to insureds. Market conditions have led to a lower risk appetite among reinsurers and insurers, with tighter capacity and terms. This reduced risk appetite is amplified as a result of uncertainty from rising natural catastrophe losses, lower returns from investment markets, supply chain interruptions and high inflation.

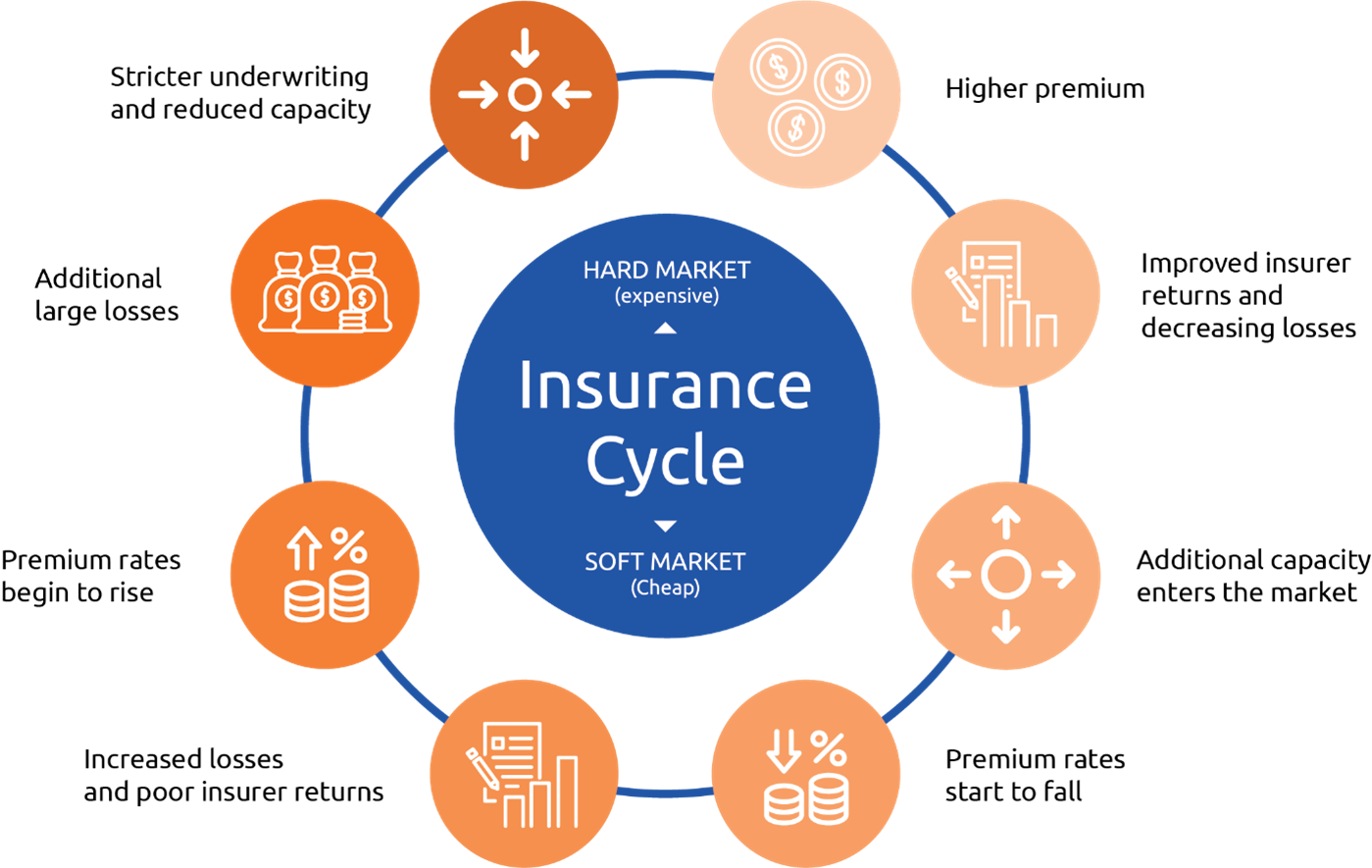

The Underwriting Cycle

The Underwriting Cycle or Insurance Cycle refers to the fluctuations in the insurance market conditions over a prolonged period, with the typical cycle spanning several years, going from boom to bust and back to boom again.

At the beginning of an Underwriting Cycle, competition is present in the marketplace, leading to lower prices and broad policy conditions, with excess capacity available in the marketplace. This is known as a “soft” market.

As prices drop, and reinsurers and insurers see a rise in claims (particularly natural catastrophe claims), their return on equity results reduce or they start to become unprofitable. This drives some providers out of the market for some products, or they completely withdraw. Poor financial results, and a reduction of available capacity in the market, leads to higher pricing and a tightening of coverage. This is known as a “hard” market.

Today, we find ourselves in a hard market.

CLAIMS

- Underlying claims trends, such as inflation, have an impact on pricing.

INVESTMENT INCOME

- Investment income supports pricing.

- Without it, pricing needs to increase.

CATASTROPHE LOSSES

- Large losses impacting industry-wide affect Underwriting Cycles, particularly when they are unrecognised or unmodelled.

CAPITAL

- Level of capital in the market drives competition and therefore pricing.

How can our Members influence pricing in a hard market?

While we cannot control the global reinsurance market, there are some tangible actions we can all do to put our best foot forward at renewal.

RISK IMPROVEMENT ACTIONS:

Members are encouraged to take the time to consider what additional actions they can take to reduce their risk profile. One simple way to do this is to ensure that all of your risk recommendations are complete, and that Unimutual has been advised of these improvements. This will help significantly when we are negotiating for reinsurance protection.

DATA QUALITY:

Underwriters assess portfolio exposure using data provided by Members. It is imperative that Members provide the most complete, up-to-date, and accurate information to support the underwriting assessment. If an underwriter doesn’t have sufficient information, they may take a more conservative approach to pricing (i.e. increase prices unnecessarily).

EARLY SUBMISSION OF MEMBER DATA:

Put simply, the earlier Unimutual can be in the market negotiating with reinsurers, the more competition we can drive for our account. More competition for our account means better pricing and coverage for our Members.

There will always be strong competition for good quality business. Taking these simple steps will allow Unimutual to influence reinsurance pricing for the benefit of Members. Member data is due in ReSure by 31 July 2023, so don’t delay.

Unimutual is here to help

RISK MANAGEMENT SERVICES:

Simon and Greg are here to support you with advice on how you can improve your risk profile and support on outstanding risk recommendations. You can contact the team at: Simon.Iliffe@unimutual.com.au or Greg.Burton@unimutual.com.au

MEMBER SERVICES:

Christine and Kerry are here to support you with any queries you have with the data collection process, or any other support you require. You can contact the team at: Service@unimutual.com.au

UNDERWRITING:

Tobias and Salinda are here to support you with questions you may have on your protection. You can contact the team at: Tobias.Pfau@unimutual.com.au or Salinda.Saat@unimutual.com.au

We welcome your feedback. For any comments or questions, please contact Service@unimutual.com.au

By Geoff Henderson, Chief Executive Officer

Login to the ‘Members Only’ dashboard to download a PDF document of this article.

More content available to Members Only

Login To Unlock The Content.