Will you be affected by the incoming Notifiable Data Breaches Scheme? And what can you do to prepare?

May 1, 2017

Campus Threat Assessment Committee Checklist

June 15, 2017By Gerald Ewing, Unimutual Chief Executive Officer

With cuts in government funding for higher education, the bottom line for Australian universities and others in the sector is often, well, the bottom line. Faced with strong downward budget pressure, it’s become commonplace for university sector clients to include reductions in costs as a KPI in contracts with their insurance brokers. With the emphasis solely on lowering fees, the real value on offer is more often than not neglected – resulting in detriment to the client in the long-run.

So how to turn the conversation around?

I’ve written before why price doesn’t equate to best and that you get what you pay for. Yes, we look at price, it’s a big factor, but we also look at what we are going to get for our money. We make an informed choice about value. But if we don’t know the right questions to ask to determine value, it’s easier to haggle on price. It’s also easier to sell a cheaper price to the boss or to the Board.

For insurance brokers, how do you highlight the value you bring to your clients?

When it comes to insurance products it’s still a very one sided bargain with the insurer holding all the cards – understanding of the small print and the legal framework in which it operates, the upper hand in negotiations, a pricing mechanism that is opaque and poorly understood, and a range of insurers and products which are hard to compare. Trying to navigate all this and commit the company to an often significant expense item without any professional guidance is a risky undertaking. Would your clients consider entering a legal dispute without a lawyer on their side? Of course not.

This is the introduction to stating the obvious that the insurance broker brings considerable benefit to the client and it’s now a question of articulating so that so that the value is understood. This is where you can talk about knowledge and experience you bring to the table, the service levels and activity, the relationships with insurance providers and others.

It’s also the opportunity to discuss how working closely with Unimutual strengthens the value proposition for your clients.

Trust is the foundation

In a business where you pay today and don’t receive the product until you lodge a claim, trust remains all important and trusted partners are a key part of the process.

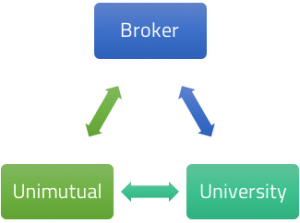

Unimutual believes this trust must built on a stable three-legged platform with a strong relationship between client and broker, broker and Unimutual and Unimutual and member.

This paves the way for exemplary personal support and service to the client/member thereby minimising the time he/she needs to spend on insurance matters and maximising time spent on core business activities.

Technology facilitates

Technology is an important factor. Unimutual provides members and brokers with time saving applications for claims management and data collection that provide efficiency for both. In a large institution this, coupled with our service from Unimutual and the broker can result in reduction of the number of FTEs required to be employed by the client.

Risk management and loss prevention should be a concern to any client looking to derive efficiency in the risk transfer process. Working with Unimutual the broker is able to provide the client with effective tools and resources at no additional cost.

Shared knowledge

Last but no means least is the scope of cover, limits and enhancements Unimutual is able to provide and the ease with which changes amendments and endorsements can be undertaken. The Unimutual broker relationship facilitates this to make the process as painless as possible.

Finally, Unimutual not only provides a product specifically tailored to universities and the higher education and research sector with broad cover and service matching their needs, it also provides a community in which universities and their broker partners can exchange knowledge and collaborate with one another.

Working together we can provide an unrivalled level of cover, service and security which will enhance client engagement, perception, and the value proposition we jointly present.