This edition of CEO Connect takes a targeted focus, sharing Unimutual’s current view on international insurance and reinsurance pricing.

Around this time each year, we engage with our local and international reinsurance partners to assess the market environment and conditions that will shape the upcoming renewal. This also gives us the opportunity to reflect on our performance across recent insurance cycles.

Through both hard and soft markets, our Mutual model has continued to deliver stable, economic pricing – ensuring long-term value and protection for Members, regardless of market volatility.

A strong relationship with our reinsurance partners in Australia and overseas is an important part in delivering value to our Members. As noted in our recent Member Matters, in May I had the opportunity to travel to London with our Chief Underwriting Officer, Tobias Pfau, to meet with key reinsurance partners across Property, Casualty, Terrorism, Pandemic and Alternative Risk Transfer lines.

These in-person engagements form a critical part of our renewal planning, allowing us to advocate directly for Members and ensure reinsurers understand the strength of the Mutual and the unique environment our Members operate in. Early signals from these meetings suggest a more positive outlook for the 2025/26 renewal. While some variation is expected across protection classes and individual risk profiles, the direction is encouraging.

Reinsurance costs are shaped by a combination of international and local factors. Recently, we’ve seen a relatively quiet period for natural catastrophes, with insurers and reinsurers returning to a more stable financial footing. This has led to new capital entering the market and an increase in reinsurer appetite, contributing to positive pressure on pricing.

However, portfolio-specific characteristics such as claims history, risk profile, geographic spread and nautral catastrophe exposure remain critical. While the broader market may ease, individual outcomes still rely on risk quality, accurate underwriting data and our ongoing commitment to risk improvement.

As shared in previous Member updates, property contributions are determined by two key factors:

When reviewing your contribution budget, it’s important to consider both your institution’s risk performance and any changes to declared asset values. It is also important to note that asset value fluctuations are not a function of the insurance market cycle. Even with softening market rates, increases in valuation will influence your overall contribution.

Unimutual remains focused on delivering sustainable pricing through disciplined underwriting, working closely with reinsurers and staying connected with Members.

We look forward to providing a more detailed market outlook at our Renewal Update Webinar on Tuesday 29 July. Invitations to the webinar have been sent via email and you can register here.

One of the pillars of our five-year strategy is Managing the Cycle, to ensure we perform through both hard and soft markets. Through this, we take a long-term approach to our strategy to align with our Member’s time horizons and missions.

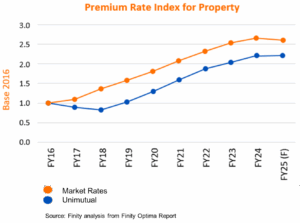

Our Mutual structure is designed with one purpose – to serve our Members. Unlike commercial insurers driven by shareholder returns, we exist solely to deliver fair, stable and sustainable protection and pricing for the higher education and research sectors. In response to Member requests for greater transparency, Unimutual has worked with market leading insurance consultant, Finity Consulting, to perform a market comparison. This study compared our contribution movements over the past decade against broader market trends, spanning both soft and hard insurance cycles.

Key Findings:

Over the past decade, Unimutual has delivered better pricing performance compared to the broader insurance market across our portfolio. Our Members have benefited from a stable and resilient pricing model that has shielded them from the volatility typically seen in commercial property insurance. This long-term advantage reflects our unwavering commitment to economic pricing and sustainable value. By leveraging a geographically diversified portfolio and deep sector-specific expertise, we are able to assess and price risk more accurately. This ensures that Members benefit from our collective strength, shared protection, and a pricing approach tailored to their unique risk profile.

Why This Matters:

Your ongoing trust helps us to uphold these principles and remain dedicated to delivering lasting value across risk protection and risk prevention.

We believe improving and sharing risk information not only supports loss prevention, but also directly improves protection outcomes.

Our close engagement with Members through risk assessments, site visits and tailored recommendations helps maintain a high-quality risk profile across the portfolio. This proactive approach gives reinsurers confidence in our Mutual and enables us to secure favourable terms.

Reinsurers consistently tell us they value this risk-first philosophy. It sets Unimutual apart from general market exposures and creates a positive feedback loop. Strong risk management attracts better support, which enables better outcomes for our Members.

While it is still early in the renewal process, the signs are positive. The market is shifting, reinsurers are supportive and our strategy is working. By maintaining our shared commitment to proactive risk management and early engagement, we are well-positioned to deliver another year of strong, stable protection for you, our Members.

Thank you, as always, for your continued trust and support. We look forward to seeing you at the Renewal Update Webinar on Tuesday 29 July, where we’ll share further insights and the outlook for the renewal ahead. If you have not received an invitation to the webinar please contact us at [email protected].

Yours sincerely,

Geoff Henderson

Chief Executive Officer

p: +61 2 9169 6604 m: +61 (0) 417 887 513

To subscribe to Emerging Risk Reports or other Unimutual updates, please email [email protected] or follow us on LinkedIn.

Thank you for subscribing to our CEO Connect newsletter. If this email has ended up in your spam or junk folder, please be assured the contents of the message and any attached documents or links are error and virus free. As such, please mark [email protected] as a ‘safe’ sender. If you no longer wish to receive this communication, please email [email protected].

Suite 11.02, Level 11, 56 Pitt Street, Sydney NSW 2000

T: 02 9169 6600

PO Box H96, Australia Square NSW 1215

ABN: 45 106 564 372 | AFS Licence No: 241142

[email protected]

Follow us on LinkedIn

Copyright © Unimutual

Privacy Policy

Whistleblower Policy

Complaints and Dispute Resolution Guide