As the only provider solely dedicated to protecting the higher education and research sector, Unimutual was formed by Members, for Members.

Unimutual is unique. With more than 30 years’ experience providing risk advice and risk protection, we have a rich heritage serving the higher education and research sector.

Member Experience

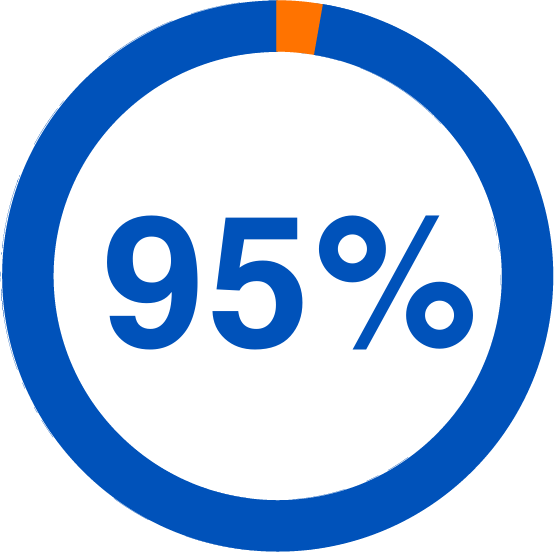

Member satisfaction

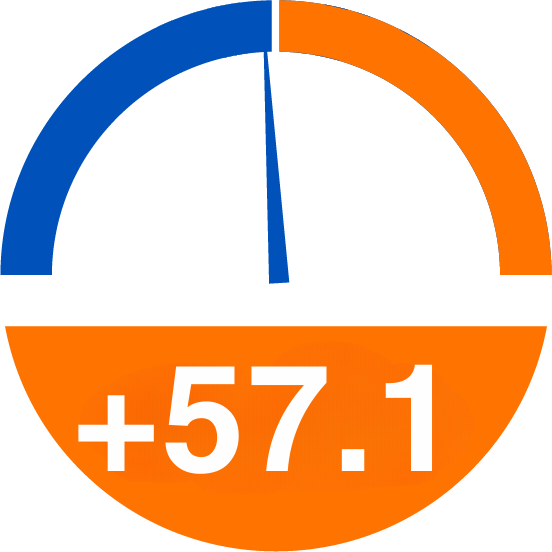

Member trust

Net Promoter Score

Why Unimutual

The higher education and research sectors present unique challenges in risk prevention and protection. Institutions within this sector require a partner who comprehensively understands their distinct needs. Unimutual stands out in this regard. Exclusively dedicated to safeguarding the higher education and research sectors, Unimutual was established by and for its Members.

As the sector’s risk protection partner, Unimutual is the only provider, specifically dedicated to the higher education and research sector. Being embedded in these sectors, we understand your risks and provide tailored solutions.

Unimutual has a unique position in fostering collaboration between Members, playing a key role in knowledge transfer through the facilitation of industry training, forums and discussion groups, to help Members develop their own policies and procedures.

As a Member, you have a share in Unimutual and you have a say in how we run our business.

As a result of our Member-owned structure we create economic value for Members. Unimutual retains surpluses during periods of low claims or high investment returns, ensuring these benefits directly contribute to the collective advantage of our membership. Read more here.

2024 Year in Review

retained surplus in 2023/24 financial year

claims paid in 2023/24 financial year

spent on Member risk mitigation initiatives

Member retention in 2023/24

Explore Unimutual

About Us

For more than 30 years, Unimutual has been owned and controlled by Members for the purpose of delivering strategic and economic value to the higher education and research sectors.

Membership

Membership is available to like-minded universities and other higher education and research institutions that have 20 or more employees.

What We Do

We provide creative risk prevention and risk protection solutions, as well as a wide array of benefits and specialist support for Members. Through training, education, tips and tools, we empower our Members to succeed.

Value Proposition

The higher education and research sectors require a partner that understands its unique risk protection needs. In this video, we explore Unimutual’s value proposition, demonstrating how we provide tailored risk solutions and create lasting value for our Members, supported by over 30 years of specialised expertise.

Strategic Vision

The higher education and research sectors have distinct needs when it comes to risk prevention and protection. In this video, we outline Unimutual’s 5-year strategy, showcasing how we will continue to create value and deliver tailored solutions for our Members, building on over 30 years of expertise.

Announcements

Half Year Update FY25

Half Year Update FY24

Unimutual becomes foundation signatory to voluntary Code of Conduct

Unimutual becomes a signatory to the Declaration of Climate Action

Log in to view the latest Member Matters and Broker Business