Broker Business Issue #2, May 2024

May 29, 2024

Unimutual Excellence Awards

July 2, 2024Our journey is one that continues to provide greater

transparency for our Members. Today, we are pleased to provide

you with a snapshot of Unimutual’s performance for the first

half of the 2023/24 protection year.

On behalf of the entire Unimutual team, I would like to thank

you, our Members, for your continued support this year.

Highlights in the first half of the 2023/24 protection year

Successful 2023/24 protection renewal

The 2023/24 protection year renewal was successfully completed on 1 November 2023, having earlier renewed our reinsurance programs, effective 1 October 2023. Each of the reinsurers on our 2023/24 program has a financial credit rating by Standard & Poor’s of A- or better (or A.M. Best equivalent).

Following Member feedback, we continue to introduce changes to how we undertake the renewal process, holding individual Member meetings, tailored presentations and providing more transparency in our documentation. 94 per cent of respondents to our Member survey found the renewal process to be good/excellent, which is up from 91 per cent last year.

Given the difficulties faced by the global insurance and reinsurance markets, the renewal of our reinsurance capacity at the levels required – and at competitive rates – are testament to the work undertaken by both the Unimutual team, and our Members, specifically in the timely and accurate submission of data.

Annual Member Conference in Hobart

Unimutual’s 2024 Conference was held on the 13-15 March at Hotel Grand Chancellor Hobart in Tasmania. This year’s theme, “Staying ahead of the curve together”, prepared our Members and stakeholders for the next phase of innovation and progress in our industry. We incorporated sessions dedicated to Member education and had an amazing line-up of speakers and a record number of attendees. As always, the conference was a fantastic opportunity for networking and collaboration between peers in the higher education and research sectors.

Unimutual Excellence Awards

The Unimutual Excellence Awards were introduced to recognise outstanding performance by our Members in the field of Risk Prevention and Risk Protection. In the first half of this year, nominations and judging of the inaugural Unimutual Excellence Awards were finalised, culminating in an awards ceremony at the Unimutual Conference in Hobart. Congratulations to all our winners:

- Insurance/Protection Services Professional of the Year – Chi Him Kong, University of Wollongong.

- Claims Management Professional of the Year – Third Party Service Provider – Jeff Wiltshire, Procare Claims and Risk.

- Claims Management Professional of the Year – Joint Winner – Amanda Harley, The University of Queensland.

- Claims Management Professional of the Year – Joint Winner – Dr Carla Tromans, International House.

- Risk Management Professional Team of the Year – University of South Australia.

- Insurance/Protection Services Professional of the Year – Highly Commended – Evan Battalis, Murdoch University Guild of Students.

Introduction of new Constitution

We are pleased our Members unanimously voted for the adoption of a new Constitution at our 2024 Annual General Meeting. The contemporary Constitution has been updated with plain language and reflects current governance approaches, Australian financial services laws and changes to the Corporations Act. We thank our Members for participating in the extensive consultation and feedback process. Your input has been invaluable and the benefits will be realised over the years to come.

Partnerships

Future Campus

In April, Unimutual announced a significant partnership with the Future Campus publication, set to span the next 12 months.

This exciting collaboration will enable Unimutual to work closely with Future Campus in crafting sector-specific articles on risk protection and prevention. With a readership of over 10,000 higher education professionals, including an impressive 90 per cent of Australia’s university Vice-Chancellors, this partnership promises to elevate our presence within the broader higher education and research sector. Feedback from our Members underscores the widespread readership of this publication across all levels of the academic community.

Key actions from our Member surveys

Feedback from the November Member Experience Survey highlighted how much our Members value our products and services, resulting in an NPS +70.4 (up from 47.2). Unimutual recorded a Member satisfaction result of 98 per cent (up from 91 per cent) and Member trust of 98 per cent (up from 89 per cent).

Feedback from this survey has led to the early development of new Member training modules, additional support for our Audit and Risk Committees as well as Member collaboration opportunities.

Fact sheets

To assist Members in their understanding of a variety of topics, Unimutual enhanced the “You asked, we listened” fact sheet series, with new content including:

- Complaints and Dispute Resolution Guide

- Cyber Protection response to Ransomware Acts, and

- Discounted Pre-incident Services and Cybersecurity Software.

These fact sheets provide a quick reference guide for Members and are available in the Member section of

the website.

Member Hub

The Member Hub is a newly introduced feature in Resure. It provides a series of dashboards enabling quick and easy access to Member information including:

- Member representative details

- Claims graphs

- Protections and policies

- Data collection status, and

- Risk recommendation status.

This hub will assist Members in the management and reporting of their data.

Training (webinars)

To provide Members with a diverse range of educational content, we engaged industry experts to present the following webinars in the first half of this year:

- Respect@Work – Held on 8 February, presented by Sian Gilbert (Partner) and Atticus Saunders (Associate) from Wotton + Kearney.

- Life Cycle of a Claim – Held on 11 April, presented by Robert Minc and Shannon Mony Principals at Meridian Lawyers.

Looking ahead – Key actions in the second half of the 2023/24 protection year

Financial forecast

Unimutual is pleased to advise our first half reported claims are trending within budget expectations, with a limited number of weather or other natural catastrophe events taking place. In addition, our first half result has been positively impacted by lower-than-budget expenses and better-than-budget investment income. As a result, we are forecasting a budget surplus, after tax, of $2 million for the full financial year.

In times of low claims or high investment returns, Unimutual retains surpluses for the future benefit of Members.

Ensuring a successful 2024/25 protection renewal

We have commenced discussions with international insurance and reinsurance markets to ensure continued availability of capacity and coverage for our Members at economic rates. Overall, our partners are supportive of Unimutual and are looking forward to continuing their support of our reinsurance programs.

As you all know, the need for detailed and accurate data is crucial for the renewal process. I urge you to undertake the COPE data collection process with diligence and provide as much information as possible within the requested timeframe. Better information will lead to better outcomes.

We look forward to sharing our preliminary thoughts with you at the Renewal Pricing Webinar on 23 July 2024.

Projects underway

As outlined at our recent conference, Unimutual has several projects underway for the 2023/24 year. These projects include:

New Unimutual website

To further improve the Member experience and access to important risk protection and risk prevention information, Unimutual is developing a new website. This website will include the functionality you currently enjoy, structured in a clearer way for easier access. When launched in September 2024, the website will be a strong foundation for further development in the coming years, continuing to increase in functionality and create further Member value.

Automation

In an environment of rising expectations around data security, a project is underway to automate the generation of documentation for the 2024/25 renewal. This will reduce the reliance on individual staff, reduce the risk of error and deliver the 2024/25 renewal documentation directly to Members from the Resure hub.

Risk services interns

In the second half of the year, Unimutual are looking to commence an intern program for engineering students.

The successful applicants will have the opportunity to gain real world experience in both risk engineering and the management of risk in the higher education and research sectors.

Financial results

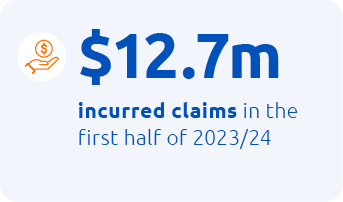

The first half of the 2023/24 financial year has not seen the same high level of natural catastrophe activity that plagued recent years.

We have paid out $43.8 million in claims in respect of both the current and prior years during the first half of 2023/24 and collected $40.5 million in reinsurance recoveries relative to those claims.

Prior year claims reserves were actuarially valued at 31 October 2023, and the claims reserve recommendations were included in the results for the year ended 31 October 2023. There has not been a material change in the claim reserves related to the prior years during the first half of this financial year.

Our investment income has exceeded budget expectations at the half year, largely due to the conservative nature of our investment strategy, interest rate increases, and an increase in the quantum of investments. Equity and bond markets are expected to continue to be volatile over the remainder of this financial year. Despite this, our focus on cash and near cash investments should continue to see our investment income exceed our budget.

Our expenses continue to be tightly managed and were below budget at the half year. We remain on track to continue to incur expenses in line with the full-year budget.

The current forecast for the full 2023/24 financial year is a surplus of $2 million.

In our full year forecast we have estimated the claims cost, which includes case estimates for incurred claims and an allowance for Incurred But Not Reported (IBNR*) claims, Incurred But Not Enough Reported (IBNER**) claims, claims handling costs, and a discount factor based on risk-free rates.

Our reinsurance recoveries remain of high credit quality, with all reinsurers having paid amounts requested within credit terms.

The Unimutual Difference

The higher education and research sector is unique. When it comes to risk prevention and protection, Members of this sector require a partner that deeply understands their specific needs.

Unimutual was formed by Members, for Members. With more than 30 years’ experience providing risk advice and risk protection, we have a rich heritage serving the higher education and research sector.

As a discretionary mutual, we exist to create value for our Members. Our focus is on sustainability as well as product and service excellence rather than driving for profit.

OUR VISION

To stand beside the higher education and research sector, protecting it as it delivers benefits to our community over generations.

OUR PURPOSE

We harness our collective expertise and experience to provide risk protection solutions shaped by the evolving needs of the higher education and research sector – to build a stronger, more resilient membership.

OUR SERVICES

Member support. Unimutual provides a range of exclusive services for our Members, including personalised engagement and risk protection solutions that meet the individual needs of each Member.

Risk management. With our thorough understanding of the unique needs of the higher education and research sector, we have developed best practices for our Members to mitigate and manage risk. These services include risk management, risk consultancy and risk engineering services.

Claims management. Our experienced claims team handles all aspects of your claim. All Members receive expert support and guidance throughout the claims process, including assessment, response and management.

Protection services. Our role is to serve our Members and provide the protection they need. The cover we offer is tailored to the changing needs of the higher education and research sector.

Training and resources. All Members have the opportunity to develop their skills and competencies through our professional development program, which includes training, networking events and thought leadership articles.

We welcome your feedback. For any comments or questions, please contact Service@unimutual.com.au

Login to the ‘Members Only’ dashboard to download a PDF document of this article.