Webinar – Renewal & Market update July 2023

July 31, 2023

CEO Connect #3, August 2023

August 16, 2023On behalf of the entire Unimutual team, I would like to begin by thanking you, our Members, for your continued support this year. We are extremely grateful for the opportunity to continue working with you. We are pleased to provide you with a snapshot of Unimutual’s first half performance for the 2022/23 protection year.

Highlights in the first half of the 2022/23 protection year

Successful 2022/23 protection renewal

Pleasingly, the 2022/23 protection year renewal was successfully completed on 1 November 2022, having earlier renewed our reinsurance programs, effective 1 October 2022. Each of the reinsurers on our 2022/23 program have a financial credit rating by S&P Global Ratings (or other recognised rating agencies) of A- or better.

Given the difficulties faced by the global insurance and reinsurance markets, the renewal of our reinsurance capacity at the levels required, and at rates lower than initially anticipated, are testament to the work undertaken by both Members and the Unimutual team.

Following Member feedback, we also introduced some changes to how we undertook the renewal process, holding individual Member meetings, tailored presentations, and providing more transparency in our documentation. Ninety-one per cent of respondents to our Member survey found the renewal process to be good/excellent.

Unimutual Annual Conference

Our Annual Conference was a highlight of the first six months of the year and being our first face-to-face conference in three years certainly added further enjoyment. The conference is a fantastic opportunity for networking and collaboration between peers in the higher education and research sector. This, together with a high-quality line-up of presenters, made for a successful conference around the theme of Resilience in a changing landscape. Ninety-five per cent of attendees rated the conference as very good/excellent.

Environmental, Social and Governance (ESG)

Over the past six months, we have considered Unimutual’s commitment and response to ESG issues, recognising that we can and should work collectively with our Members. Through this process, we have identified opportunities for increased prosperity and resilience through a fair and just transition to a carbon neutral position.

Unimutual has already made two key commitments under our first ESG Plan.

Firstly, in December 2022 Unimutual committed to a higher governance standard, signing up to the Business Council of Cooperatives and Mutuals (BCCM) Principles, Code of Conduct and Good Practices for Discretionary Mutual Funds.

In addition, the Mutual became a signatory to the BCCM’s Declaration of Climate Action. We will continue to work with our Members to provide tailored risk protection and prevention that meets current climate action targets.

Further information on our ESG Plan for 2023-2025 can be read here.

Partnerships

Earlier this year I had the opportunity to meet with organisations similar to Unimutual that are specialists in supporting the higher education and research sector in both Canada and the United Kingdom - the Canadian Universities Reciprocal Insurance Exchange (CURIE) and UM Association Limited (UMAL) in the UK. It was very interesting to discuss the challenges we have in common and to consider where we could partner for the benefit of our Members. Through these collaborative partnerships, Unimutual will have access to global best practice in risk prevention and risk protection to share with Members.

First half financial outcome

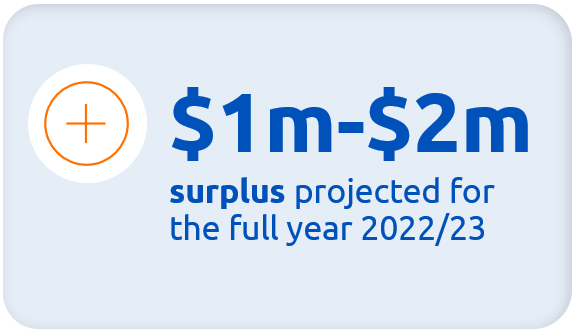

I am pleased to advise our first half reported claims are trending within expectations, with no major weather or other natural catastrophe events having taken place. In addition, our first half result has been positively impacted by lower-than-budget expenses and better-than-budget investment income. As a result, we are forecasting a small surplus, after tax, of between $1 million and $2 million for the full financial year. In times of low claims or high investment returns, Unimutual generates and returns surpluses to Members through increased benefits. Our aim is to maximise the benefits provided to Members.

Looking ahead - Key actions in the second half of the 2022/23 protection year

Ensuring a successful 2023/24 protection renewal

We have begun discussions with global insurance and reinsurance markets to enable continued availability of capacity and coverage at reasonable rates. Overall, our partners are supportive of Unimutual and are looking forward to continuing their support of our reinsurance programs.

As you all know, the need for detailed and accurate data is so important for the renewal process. I urge you to undertake the COPE data collection process with diligence and provide as much information as possible. Better information will lead to better outcomes.

We look forward to sharing our thoughts with you at the Renewal Update Webinar on 27 July 2023.

Fine Art, Rare Books and Collectibles protection

In response to Member feedback, we are in the process of launching a Fine Art, Rare Books and Collectibles protection for the 2023/24 period. We look forward to sharing the details of this specific offering soon.

Five-year strategy consultation

As announced at our Annual Conference, Unimutual has created a five-year strategy to shift our thinking from an annual cycle to a longer-term view of how we can continue to create value for our Members. In the second half of the year we will be sharing further details on the proposed strategy for Member consultation.

Key actions from our Member surveys

Our recent Member surveys have included feedback on where we can offer more value for our Members. This feedback has highlighted the need for more Member training, as well as more opportunities for peer-to-peer collaboration across the sector.

In response, we have created a Member introduction training program to be rolled out over two 90-minute sessions, beginning in August. This program will support the development of our Members and share information on how Members can get the most out of their Mutual. To register for this introduction training program, email: service@unimutual.com.au.

Members have also requested more opportunities to collaborate with peers across the higher education and research sector. We are in the process of developing platforms for peer-to-peer collaboration and will be sharing details with our Members in the second half of the year.

I would like to thank all of our Members for their ongoing support, and to our team for their commitment and professionalism in the delivery of our services to our Members.

Financial results

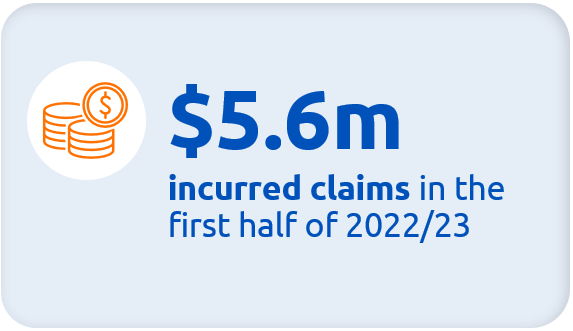

The first half of the 2022/23 financial year has not seen the same high level of natural catastrophe activity that plagued the first half of the 2021/22 financial year. As a result, we have seen fewer claims being reported in the first half of 2022/23 compared with the same period in 2021/22.

In our half year results we have estimated the claims cost, which includes case estimates for incurred claims and an allowance for Incurred But Not Reported (IBNR*) claims, Incurred But Not Enough Reserved (IBNER**) claims, claims handling costs, and a discount factor based on risk free rates.

We have paid out $67.2 million in claims in respect of both the current and prior years during the first half of 2023 and collected $62.2 million in reinsurance recoveries relative to those claims.

Prior year claims reserves were actuarially valued at 31 October 2022, and the claims reserve recommendations were included in the results for the year ended 31 October 2022 as well as the financial position at that date. There has not been a material increase or decrease in the claim reserves related to the prior years during the first half of this financial year.

Our investment income has exceeded budget expectations at the half year, largely due to the conservative nature of our investment strategy, interest rate increases, and an increase in the quantum of investments. Equity and bond markets are expected to continue to be volatile over the remainder of this financial year. Despite this, our focus on cash and near cash investments should continue to see our investment income at least match our budget.

Our expenses continue to be tightly managed and were lower than the budget at the half year. We remain on track to be below budget at year end.

The current forecast for the full 2022/23 financial year is a small surplus of between $1 million and $2 million.

Our reinsurance recoveries remain of high credit quality, with all reinsurers having paid amounts requested within reasonable credit terms.

*IBNR is a type of reserve used as the provision for claims and/or events that have transpired but have not yet been reported to the Mutual.

**IBNER are loss reserves to allow for the increase to an existing reserve as there was not enough reserved.

The Unimutual Difference

The higher education and research sector is unique. When it comes to risk prevention and protection, Members of this sector require a partner that deeply understands their specific needs.

Unimutual was formed by Members, for Members. With more than 30 years’ experience providing risk advice and risk protection, we have a rich heritage serving the higher education and research sector.

As a discretionary mutual, we exist to create value for our Members. Our focus is on sustainability as well as product and service excellence rather than driving for profit.

OUR VISION

To stand beside the higher education and research sector, protecting it as it delivers benefits to our community over generations.

OUR PURPOSE

We harness our collective expertise and experience to provide risk protection solutions shaped by the evolving needs of the higher education and research sector – to build a stronger, more resilient membership.

OUR SERVICES

Member support. Unimutual provides a range of exclusive services for our Members, including personalised engagement and risk protection solutions that meet the individual needs of each Member.

Risk management. With our thorough understanding of the unique needs of the higher education and research sector, we have developed best practices for our Members to mitigate and manage risk. These services include risk management, risk consultancy and risk engineering services.

Claims management. Our experienced claims team handles all aspects of your claim. All Members receive expert support and guidance throughout the claims process, including assessment, response and management.

Protection services. Our role is to serve our Members and provide the protection they need. The cover we offer is tailored to the changing needs of the higher education and research sector.

Training and resources. All Members have the opportunity to develop their skills and competencies through our development program, which includes training, networking events and thought leadership articles.

We welcome your feedback. For any comments or questions, please contact Service@unimutual.com.au

Message from the CEO, Geoff Henderson

Login to the ‘Members Only’ dashboard to download a PDF document of this article.

More content available to Members Only

Login To Unlock The Content.